要跟上似乎总是在变化的复杂税法并不容易, much less figure out how they might affect you personally. Even so, 在做出许多类型的财务决策时,考虑税收的潜在影响是很重要的.

美国国税局每年根据通货膨胀自动调整标准扣除额和所得税等级. The rate of inflation rose to 40-year highs in 2022, 因此,2023年7%的增幅是自1985年开始调整以来的最大增幅.1 The standard deduction is $13,850 for single filers in 2023 (up $900 from 2022) and $27,700 for married joint filers (up $1,800).

2023年联邦所得税申报表的提交截止日期是4月15日, 2024, (April 17 in Maine and Massachusetts, due to local holidays). Even though the 2024 tax year is well underway, 你可能还有时间采取措施降低2023年的纳税义务.

Understand “marginal” tax rates

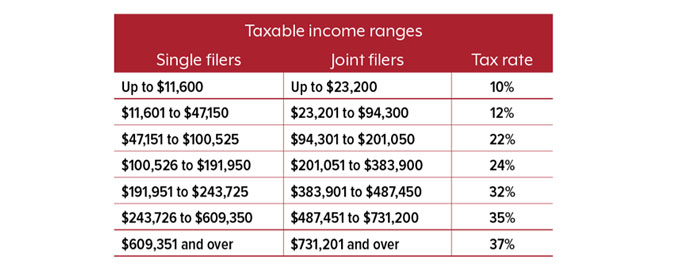

U.S. 税率按收入水平或等级逐级递增(见表). 如果你的应税收入增加,使你进入更高的等级, 由此导致的增税可能并不像乍一看那么糟糕. For example, 如果您和您的配偶共同申报2023年的纳税,并且应纳税收入为110美元,000, you are in the 22% tax bracket. 但是,你不需要为所有收入支付22%的税率,只需要为超过94,300美元的收入支付22%的税率.

确定某些扣除额的价值还取决于你的收入在税收等级中的位置. Using the same example, a $10,000 deduction would reduce your income from $110,000 to $100,000 and theoretically reduce your tax liability by $2,200 (22% x $10,000). For a $20,000 deduction, 你必须计算22%和12%的扣除额:22% x 15美元,700 + 12% x $4,300 ($3,454 + $516 = $3,970).

Although it’s helpful to know your marginal rate, 你的有效税率——你的收入被征税的平均税率(由你的总税收除以应税收入决定)——可能提供一个更好的方法来衡量你的纳税义务.

2024 Federal Income Tax Brackets

Source: Internal Revenue Service, 2023

Deduct large casualty losses

Wildfires, tornadoes, severe storms, flooding, landslides. 美国在2023年遭受了创纪录的数十亿美元的灾难.2 If something you own was damaged or destroyed by a disaster, 而且你的损失超过了你调整后的总收入(AGI)的10%加上100美元, 你可以在你的联邦所得税申报表上申请逐项扣除. 这通常适用于未投保或受高免赔额限制的重大损失. For 2018 to 2025, 个人伤亡损失只有在属于联邦宣布的灾难时才可以扣除.

The rules relating to casualty losses can be complicated. 如果你遭受了重大损失,咨询税务专家可能是值得的.

Apply for an extension

If you can’t meet the filing deadline for any reason, 您可以使用IRS表格4868申请并获得六个月的自动延期. (否则,如果你欠税,你可能会面临未申报罚款.)你必须在原到期日之前申请延期. For most individuals, that’s April 15, 2024; the deadline for extended returns is October 15, 2024.

延期提交纳税申报表并不会推迟纳税. 估计你的纳税义务,并在原到期日之前支付你预计欠下的金额. 任何未按时缴纳的税款将被征收利息并可能被罚款.

Pay yourself instead

在2023年,向传统的个人退休账户和/或现有的合格健康储蓄账户(HSA)提供可扣除的捐款,可以降低你的税单,增加你的储蓄. 如果符合条件,您可以在2024年4月15日纳税截止日期之前向您的账户缴款.

The 2023 IRA contribution limit is $6,500 ($7,000 in 2024). 如果你的年龄在50岁或以上,你可以额外缴纳1,000美元的补缴款. If you or your spouse is covered by a retirement plan at work, 在收入水平较高时,扣除供款的资格将逐步取消.

If you were enrolled in an HSA-eligible health plan in 2023, you can contribute up to $3,850 for individual coverage or $7,750 for family coverage. (The limits for 2024 are $4,150 and $8,300, respectively.)每位55岁或以上(但没有参加医疗保险)的符合条件的配偶都可以额外缴纳1美元,000.

Avoid scams and costly mistakes

纳税季节是身份窃贼的黄金时间,他们可能会以你的名义欺诈性地提交纳税申报表,并要求退款——这可能会推迟欠你的任何退款. 或者你可能会收到冒充国税局的骗子发来的威胁电话或电子邮件,要求付款. 请记住,国税局永远不会通过电子邮件与您联系,要求您提供个人或财务信息, 而且不会不寄账单就打电话告诉你欠税的事. If you think you may owe taxes, contact the IRS directly at irs.gov.

The IRS has examined less than 0.5% of all individual returns in recent years, 但该机构表示,计划增加对高收入纳税人和大型企业的审计,以帮助弥补税收损失. 无论你的收入在哪里下降,你可能都不想让别人注意到你的回报.3 Double-check any calculations you do by hand. 如果你使用税务软件,扫描条目以确保数学和其他信息是准确的. 一定要输入所有的收入,并使用良好的判断扣除. Keep all necessary records.

Finally, 如果您对您的个人情况有疑问和/或不适合自己准备报税表, consider working with an experienced tax professional.

Tax Season News and Survival Tips

Tax Season News and Survival Tips